Describe the Year-end Closing Process

Lets look at another example to illustrate the point. Preparing for a remote audit 2.

Very Brief Outline Into What You Need To Adjust At The End Of Your Financial Year To Get Correct Figur Marketing Process Accounting And Finance Excel Tutorials

Since income statement accounts record current year activity they must be zeroed out or closed in preparation of the next accounting period.

. Although the closing process must be well orchestrated it doesnt have to overwhelm. After the system is configured the year-end close process can be run. So it looks like your books are closed for the year but this isnt a formal close process.

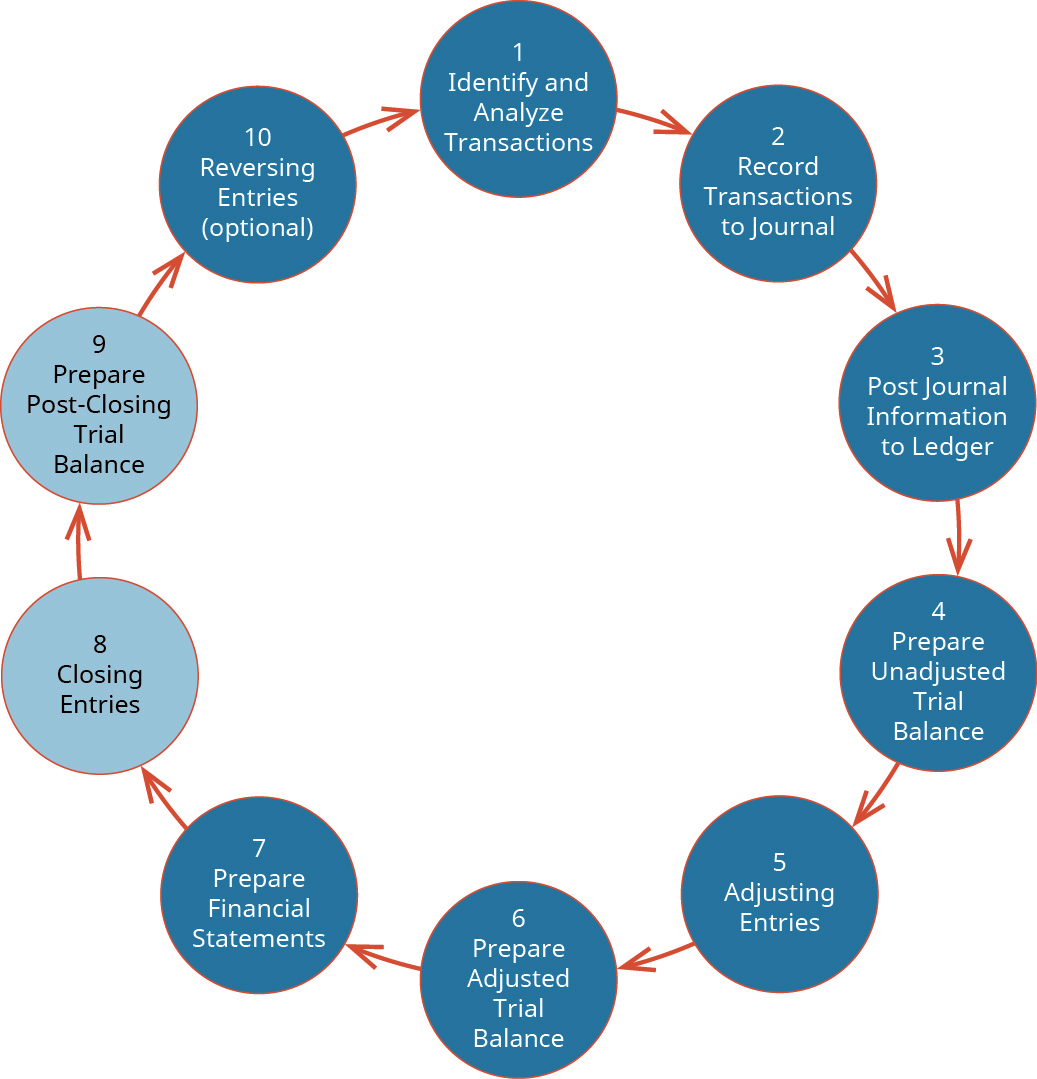

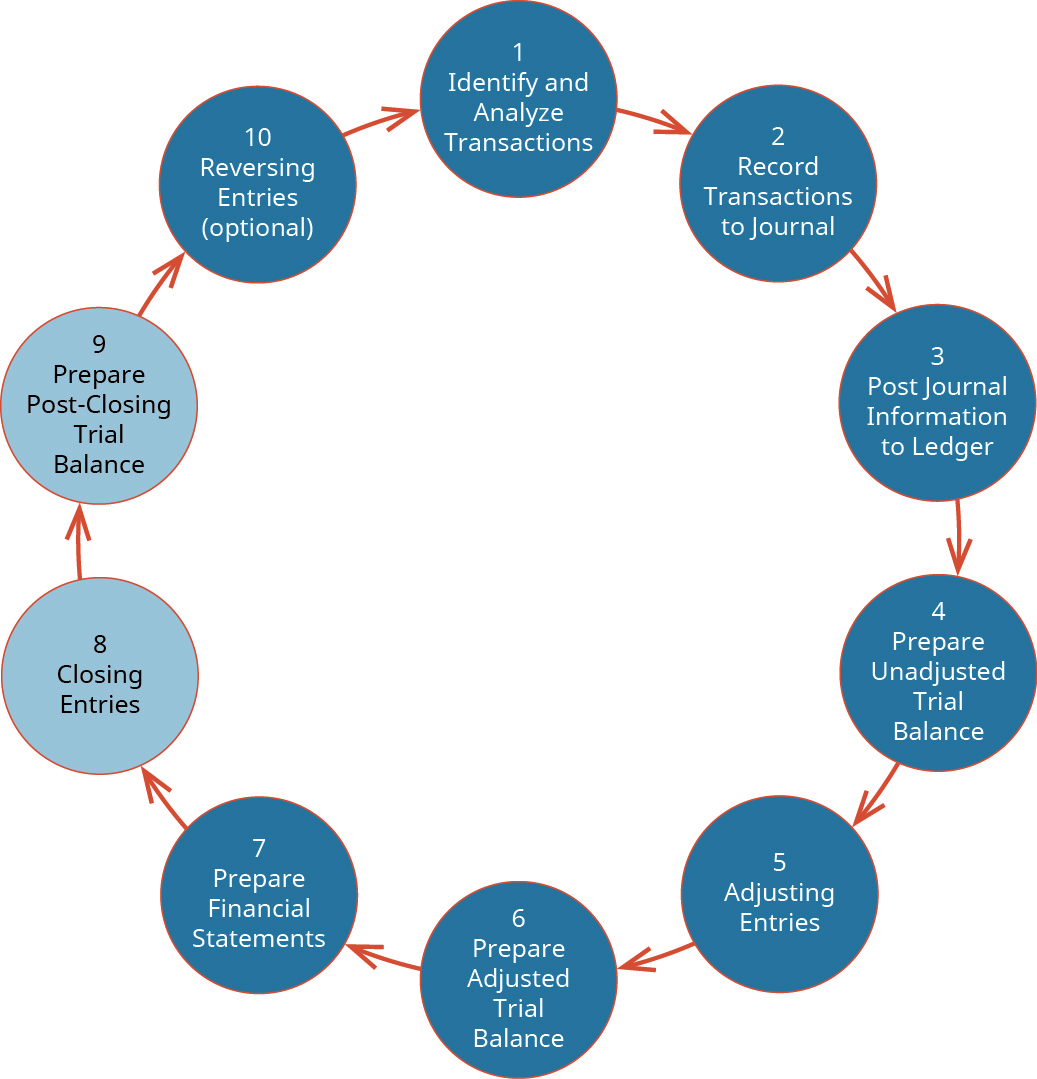

This process makes it easier to do. Verifies that the current month is the last month of this fiscal year. The Year-End Closing process consists of the following steps.

Accountants may perform the closing process monthly or annually. Ideally activity should be recorded when it happens rather than waiting until the end of the month. Prepare the post closing trial balance.

The closing entries are the journal entry form of the Statement of Retained Earnings. Assume you own a small landscaping business. For more information see Inquiry form.

The closing process consists of steps to transfer income statement accounts to balance sheet accounts. The year-end closing routine moves all profit and loss account balances to the retained earnings account. Run the year-end close process.

After the year-end close templates are created you can initiate the year-end close. Make sure you check these eight procedures off your year-end accounting closing checklist before the year officially comes to a close. AP and payroll accruals 5.

Cash and investments 4. The process continues until the financial statement audit and. If it is the last month the Close Fiscal Year process will close this month as its first step.

Close revenues Close expenses Income Summary Close owner withdrawals STEP 1 Close Revenues. Year-end close Define year-end close templates. The goal is to make the posted balance of the retained earnings account match what we reported on the statement of retained earnings and start the next period with a zero balance for all temporary accounts.

While this may seem straight forward. The Year -End Closing Process August 26 2020. The closing process consists of three main steps.

Year-end adjustments and planning 3. Your financial statements are a lifeline for your small business. It is the end of the year December 31 2018 and you are reviewing your financials for the entire year.

Identify temporary accounts that need to be closed. The agency enters fund information including Treasury Symbol Appropriation Group and Appropriation Time Frame for. This step closes all revenue accounts.

Click Retrieve purchase orders in the lower pane to select purchase orders for the year-end process. O The end of the fiscal year process performs the following functions. Transfer the balances of all revenue accounts to income summary account.

When doing this the accounting personnel review all revenue accounts and identify each account with a balance. Basically the year-end closing process is keeping a record of all the current activity that happens within that year which closes out any business that was done the year before and prepares the business for the upcoming year. When you set the year-end in Intuit QuickBooks the program automatically zeroes out all the income and expense accounts and transfers the balance of net income to Retained Earnings when your fiscal year ends.

Step 1 closing the revenue accounts. There are four steps in the closing process. Closing the books at the end of the year means that youre locking transactions that occurred before the closing date so transactions cant be added or edited.

If it is not a warning message will appear. Record daily operational financial transactions. The year-end closing routine summarizes balance sheet accounts and brings the balances forward as the beginning balances of the account in the new fiscal year.

This is just a bookkeeping reset for the next year. Step 2 closing the expense accounts. The agency defines Year-End Sequence Order Appropriation Status and Closing Account From and To in the Define.

This process begins after June 30 UCSFs fiscal year-end close date. Closing the books includes transferring journal entries to the general ledger preparing trial balances and using closing entries to clear revenue and expense accounts. Keep in mind that the recording of revenues expenses and dividends do not automatically produce an updating debit or credit to Retained Earnings.

It is done by debiting various revenue accounts and crediting income summary account. This year AMS will close for year-end processing on Thursday April 28 2022 at 700 pm and will re-open on Monday May 2 2022 at 700 am except the Capital Projects Portal and uSOURCE both of which will open on Monday May 2 2022 at 900 am. The first step in the year-end closing process is to close revenues.

Gather and analyze financial statements. Reverse the year-end close process. Closing the books properly also ensures that your bookkeeping system is in good order and is generating accurate numbers to include in your tax return.

Closing the books on a monthly basis is also a common practice. Ensure you have the invoice that crosses year end Review for any retainage and record. Closing is a mechanism to update the Retained Earnings account in the ledger to equal the end-of-period balance.

They give you a glimpse of where your business stands financially. Lets break down the major tasks into a series of eight steps. For our purposes assume that we are closing the books at the end of each month unless otherwise noted.

Small business owners need to close their books at year end in order to properly file their income tax returns. This opens a query form where you can select purchase orders by criteria such as the date date range vendor account purchase order type purchase order balance or financial dimensions.

Describe And Prepare Closing Entries For A Business Principles Of Accounting Volume 1 Financial Accounting

The Accounting Cycle And Closing Process Principlesofaccounting Com

Month End Closing Process Ppt Business Powerpoint Templates Month End Months

Keeping Track A Checklist For Your Nonprofit S Month And Year End Checklist Payroll Template Nonprofit Management

Comments

Post a Comment